About

A longstanding global bank, operating for over two centuries and spanning 160 countries.

CHALLENGE

Upgrading Legacy Technologies

The Bank faced the challenge of upscaling and rationalising legacy technologies and systems implemented at different times in various geographies.

The need for the delivery of speed, flexibility, and reliability in trading systems led to the decision to replace the incumbent FIX solution with Chronicle’s FIX solution and microservices framework, leading to a rapid delivery of quality tested, microsecond latency trading applications.

SOLUTION

FIX Deployment, Microservices Implementation and Continued Consulting

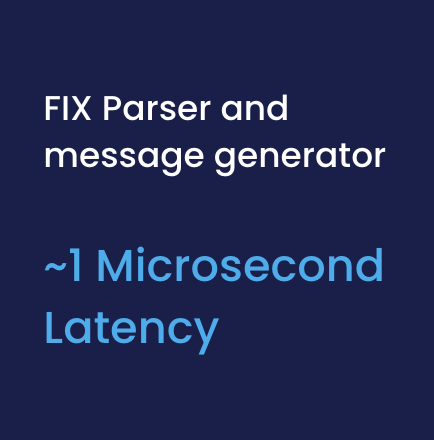

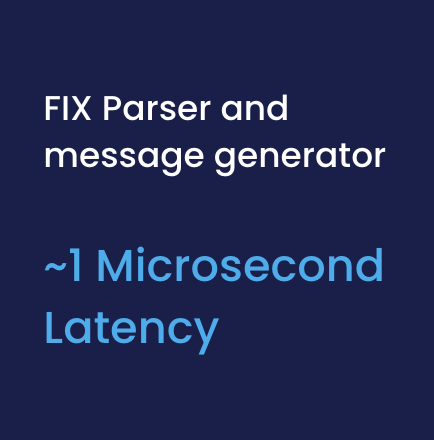

- Chronicle FIX Deployment: The bank deployed Chronicle FIX, ensuring a consistent, high-performing, microsecond latency FIX experience for their clients. This approach eliminated legacy technology burdens and minimised ongoing support costs.

- Custom Microservices Implementation: Partnering with Chronicle’s software specialists, the bank implemented tailored event-driven microservices to enhance pricing, auto hedging, order management, and market connectivity. The collaborative effort resulted in a solution that exceeded the bank’s stringent requirements.

- Continued Consulting: Chronicle experts conducted collaborative workshops, enabling effective knowledge transfer for the bank to operate independently post project production. The bank now possesses the necessary skills to independently build and deploy custom components. However the bank has chosen to keep Chronicle’s specialists as consultants to benefit from their expertise, ensuring ongoing ‘best-in-class’ performance.

Learn more about how our unique approach, has earned us the trust of 8 of the largest 11 investment banks in the world.

RESULTS

Rapid Delivery of Low-Latency, Reliable Trading Applications

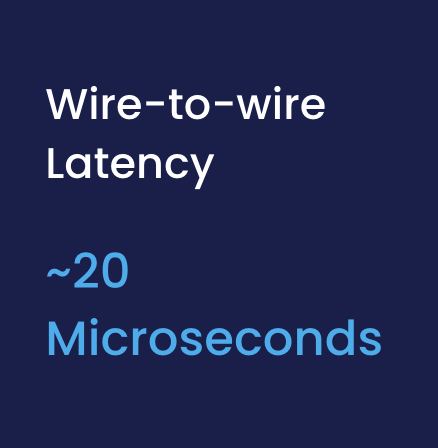

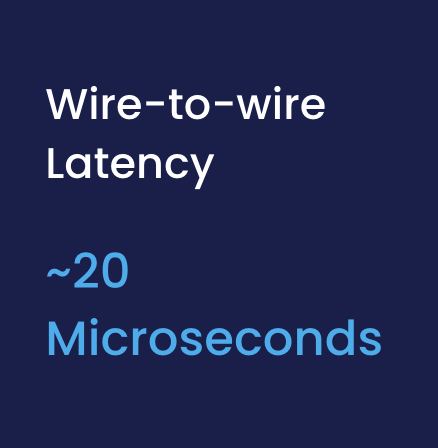

- Exceptional Performance: Chronicle’s Java solution in 2017 achieved better than 20 microsecond wire-to-wire latency 99.9% of the time, meeting and exceeding the bank’s demanding use case requirements.

- Consultative Partnership: Chronicle’s ongoing consulting services ensured that Anonymised Bank continued to benefit from best-in-class performance and expertise. Anonymised Bank has since acquired numerous new products from Chronicle.

This collaboration between Chronicle and the Tier 1 bank demonstrates the successful transformation of legacy trading systems emphasising speed, flexibility, and reliability.

Chronicle’s innovative solutions not only met Anonymised Bank’s specific connectivity and infrastructure criteria but also provided a framework for the rapid delivery of low-latency, reliable trading applications. The efficient global licensing model further showcased Chronicle’s commitment to delivering enabling technology in the financial sector, making it a catalyst for transformational change in electronic trading platforms worldwide.

Products Used

Chronicle Tune is software that automatically configures your OS for optimal performance based on our knowledge and expertise.

A FIX Engine with high availability and microsecond latency, utilised for upstream and downstream connectivity.

A framework for developing event-driven architecture/microservices for custom pricing, hedging and algo strategies.