"Using Chronicle’s solution as the building blocks, we will continue to deepen our capabilities to provide our customers with faster access to global FX markets"

- Leslie Foo, Head of Group Global Markets, UOB

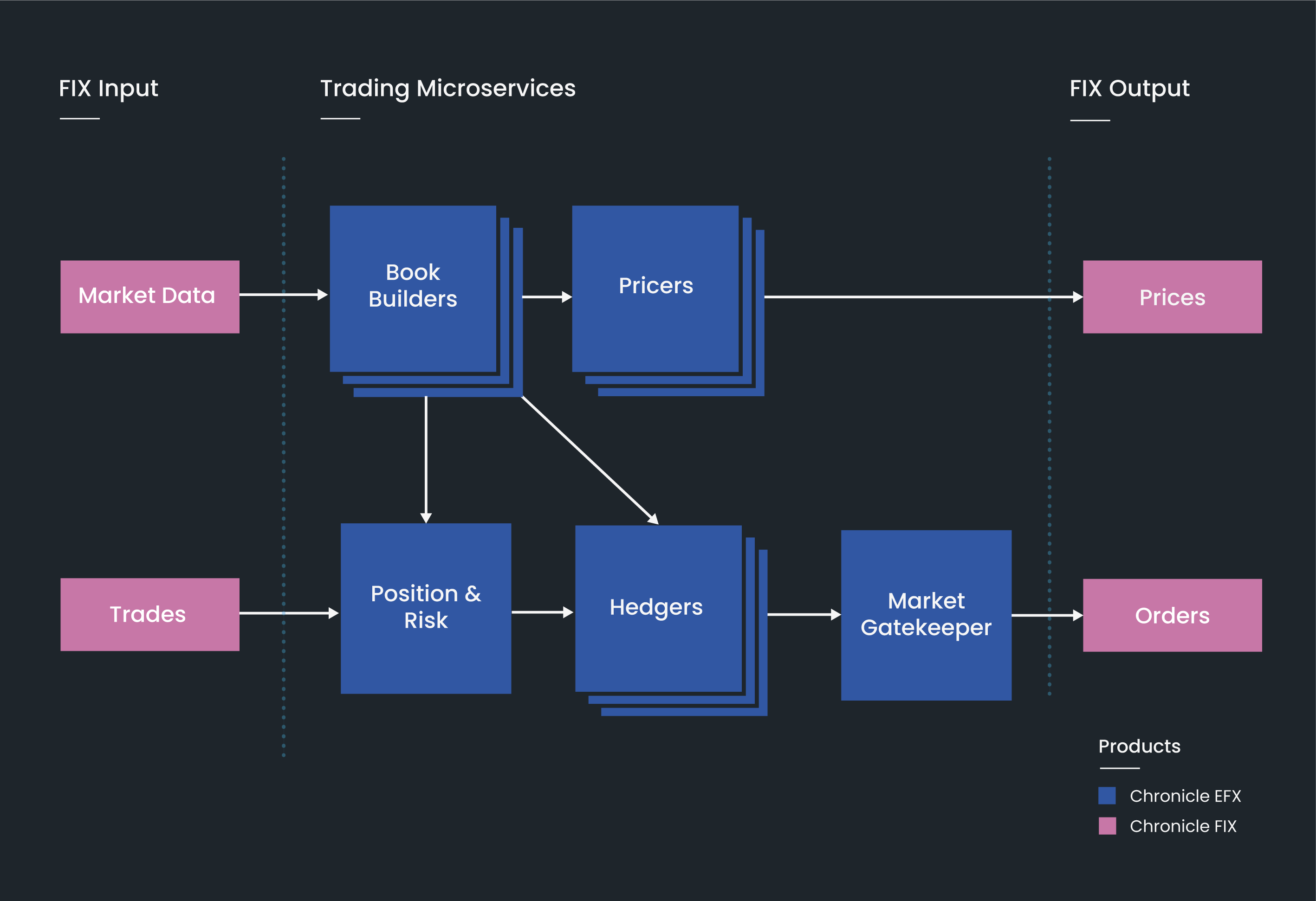

Microservices

Chronicle provides the basis of a full trading platform including Chronicle's FIX Engine and ready-made microservices: book builder, position manager, order gateway, P&L calculation, auto-hedging, and pricing frameworks, which can be customised - full source code provided.

Licensing and Support

At Chronicle we pride ourselves on the experience and knowledge of our development and support team. With decades of experience from the financial industry, you can trust us with your toughest challenges.

Get Expert Help

Our expert consultants are ready to support you with any issues that may arise. We understand that the EFX trading platform is usually only a small part of a system, and our experienced developers can help with architecture and latency issues in other areas if needed.

Simple Licensing Model

Our simple and transparent licensing model provides certainty and ensures that Chronicle’s low-latency EFX trading platform is available to businesses of all sizes, from the largest bank to the smallest hedge fund.

Chronicle EFX in Action

Chronicle has supplied trading solutions to many top tier financial institutions. Read one of our case studies to understand what you can achieve with Chronicle’s low-latency EFX trading platform.

Replacement of Legacy EFX Platform

Chronicle helped a large Asian bank to replace their third-party trading platform and assisted with their move to co-location. The new system used the following components to build custom pricing, hedging and algorithms.

- Chronicle FIX for all upstream and downstream connections

- Chronicle EFX off-the-shelf components

- Chronicle Services

- Chronicle Queue Enterprise

A small team of the bank's developers, together with Chronicle consultants, implemented the system from start to production in 7 months. Latencies were drastically reduced, and a 2+1 high availability and disaster recovery was implemented. The bank was then able to implement and deploy its hedging and pricing IP rapidly.

Quick ROI on EFX Trading Platform

Chronicle built a bespoke EFX trading platform for a top-tier bank. By leveraging Chronicle FIX and EFX microservices the system was deployed within six months. By then, message throughput was increased up to ten times, allowing a more comprehensive range of strategies that utilise the whole book. ROI was in 3 months. Learn more >>

Articles about Chronicle EFX

Introduction to Chronicle Services Traditionally, low latency trading systems were developed as monolithic applications in low level languages such as C++. While these systems delivered the required performance, the development effort was extremely time consuming,…

In this blog post, we are going to focus on microservices – what they are, what benefits they can provide for your organisation, and how they can not only provide immediate improvements in trading system…